Want to trade large amounts of cryptocurrency without affecting market prices? OTC (over-the-counter) trading is the go-to solution for institutions and high-net-worth individuals. It allows private, direct negotiations while avoiding public exchange disruptions.

Here’s what you’ll learn:

- What OTC trading is and how it works.

- Settlement models: Direct, desk-facilitated, and escrow-based options.

- Key steps for secure settlements, including KYC, compliance, and risk management.

- Practical tips to avoid costly mistakes during transfers.

OTC settlement ensures smooth transfer of fiat and crypto between parties, but it requires precision, trust, and preparation. Let’s break down how to do it right.

OTC TRADE LIFE CYCLE | Complete Step-by-Step Guide

3 Main OTC Settlement Models

When settling an OTC crypto trade, there are three main models to choose from, each with its own workflow and level of risk. Knowing how these models work can help you pick the best option based on the size of your transaction, your relationship with the counterparty, and how much risk you’re willing to take.

Bilateral direct settlement is the most straightforward approach. In this model, two parties – like a hedge fund and a mining company – deal directly with each other without involving any intermediaries. The buyer transfers fiat currency to the seller’s bank account, while the seller sends crypto to the buyer’s wallet. If all compliance checks are completed, this can settle on the same day (T+0). This method is quick and private, making it ideal for trusted partners. However, it comes with high counterparty risk since there’s no third party to step in if one side doesn’t deliver. It’s best suited for parties that have already established trust through smaller, successful trades.

Desk-facilitated settlement involves an OTC desk that acts as a middleman, either coordinating the trade or taking the role of the principal. The desk handles liquidity sourcing, provides pricing, and oversees the settlement process. Assets are often held by regulated custodians like Fireblocks, Coinbase Custody, or BitGo, which use insured, multi-signature wallets until the trade is finalized. Typically, crypto or stablecoins settle on T+0, while fiat transactions settle on T+1. This model reduces operational risks by following standardized procedures and compliance checks, but it does introduce credit risk since you’re relying on the desk to fulfill its role.

Escrow-based settlement adds an extra layer of security by involving a neutral third party. In this setup, the seller deposits crypto into escrow, and the buyer sends fiat to the same escrow account. The assets are only released once both sides meet their obligations. This method is particularly useful for large transactions between parties who haven’t worked together before or for trades across regions with different legal systems. Settlement times typically range from T+0 to T+1, though delays can occur due to blockchain confirmations or payment processing. While this model reduces the risk of delivery-versus-payment issues, it’s more complex and comes with additional fees. Some escrow services now use smart contracts to automate the process on-chain, but users must ensure these contracts are thoroughly audited and understand that blockchain actions can’t be reversed.

Each model has its strengths and is suited to different situations. Bilateral settlement is a good fit for trusted partners, desk-facilitated settlement offers professional support for institutional-scale trades, and escrow-based settlement provides extra security for high-stakes or unfamiliar transactions. Next, we’ll explore how pre-trade preparation can help ensure a smooth and secure settlement process.

Pre-Trade Preparation for OTC Settlement

Proper preparation before trading in the OTC market is essential for ensuring smooth and compliant settlements. Here’s a breakdown of the key steps you need to take before initiating a trade.

KYC and Compliance Requirements

Before trading on any regulated OTC platform, you’ll need to complete Know Your Customer (KYC) and Anti-Money Laundering (AML) checks. This typically involves submitting government-issued identification, proof of address, and documentation showing the source of your funds. AML procedures also include screening parties against sanctions lists and identifying any unusual activity patterns. These steps aren’t just regulatory requirements – they help establish trust between trading parties.

For U.S.-based traders, the rules are even stricter. Regulations under the Bank Secrecy Act and FinCEN require additional due diligence for transactions exceeding $10,000. You may also need to file Suspicious Activity Reports (SARs) if irregularities arise. Skipping these steps can lead to frozen funds or enforcement actions. To avoid such pitfalls, services like BeyondOTC can simplify the process by offering legal guidance and connecting you with blockchain-focused legal experts, ensuring compliance without unnecessary delays.

Counterparty and Liquidity Checks

Knowing who you’re trading with is just as critical as meeting compliance standards. Buyers should provide proof of funds, such as bank statements showing their ability to cover the transaction amount plus fees. For instance, in a $1 million Bitcoin trade, you’d expect to see at least $1,020,000 available to account for transaction costs. Sellers, on the other hand, should offer on-chain proof of their cryptocurrency holdings. This can include blockchain explorer screenshots or custody statements from providers like Fireblocks or Coinbase Custody.

It’s also wise to assess the financial stability of your counterparty. For institutional traders, request balance sheet audits or third-party credit reports to gauge their default risk. Reviewing trade history or seeking references can also provide insights into their reliability. Platforms like BeyondOTC, which pre-screen participants within their network, can save you time by connecting you with verified and trustworthy traders.

Settlement Instructions and Documentation

Clear and detailed documentation is critical to avoid disputes and delays. A formal trade confirmation agreement should outline all the essential details: the exact quantity of the asset, the agreed price in USD, payment methods (including wire transfer details and SWIFT codes), wallet addresses, and the settlement date – whether same-day (T+0) or next-day (T+1). Be sure to include terms for resolving disputes and ensure all parties sign the agreement, either digitally or via email, to maintain a clear audit trail.

Ambiguity in settlement instructions can lead to costly errors. For example, vague directions like "transfer to wallet" without specifying the wallet address can create confusion. A clear example would be: “15.5 BTC @ $64,516/BTC = $1M USD, settling T+0 via ACH to a U.S. bank account ending in 4567”. Before finalizing, confirm all trade details – such as USD and crypto amounts, wallet addresses, and payment methods – through secure channels. Following a structured process – completing KYC/AML, exchanging proof of funds and holdings, and drafting detailed settlement instructions – can help you avoid unnecessary complications.

sbb-itb-7e716c2

Step-by-Step Guide to Fiat-to-Crypto OTC Settlement

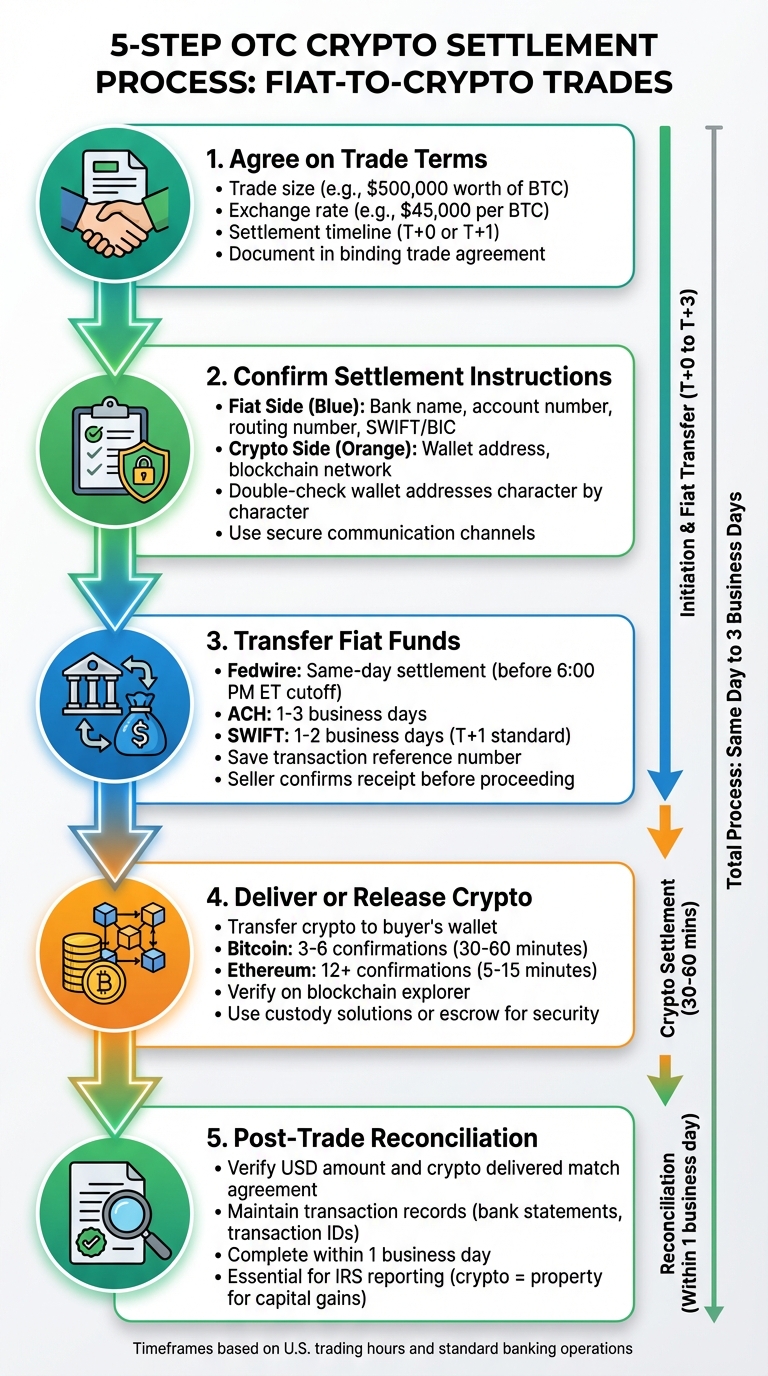

5-Step OTC Crypto Settlement Process for Fiat-to-Crypto Trades

Once you’ve wrapped up your pre-trade preparations, it’s time to move forward with the settlement process. Here’s how U.S. traders can ensure a smooth fiat-to-crypto OTC settlement.

Step 1: Agree on Trade Terms

Start by negotiating the key details with your counterparty. This includes the trade size (e.g., $500,000 worth of Bitcoin), the exchange rate (such as $45,000 per BTC to lock in a fixed price and avoid market fluctuations), and the settlement timeline, which depends on the payment method.

Once you’ve settled on the terms, document everything in a binding trade agreement. This should clearly outline the cryptocurrency quantity, total USD amount, and any fees involved. Having this agreement in writing not only protects both parties but also provides a clear audit trail, which is particularly important for large transactions.

Step 2: Confirm Settlement Instructions

Before transferring any funds, exchange and verify settlement instructions with your counterparty in writing. For the fiat side, make sure you have all the necessary bank details, including the bank’s name, account number, routing number (ABA for domestic transfers), and SWIFT/BIC codes for international transactions. For the crypto side, confirm the wallet address and specify the blockchain network (e.g., Bitcoin mainnet or Ethereum) to avoid routing errors.

Double-check wallet addresses character by character, as even a small mistake can lead to irreversible losses. If you’re dealing with a new counterparty, consider doing a small test transaction first. Use secure communication channels, like encrypted email or verified messaging platforms, to exchange details, and ensure both parties acknowledge their accuracy in writing. This step is critical to avoiding costly settlement errors.

Step 3: Transfer Fiat Funds

The buyer initiates the wire transfer to the seller’s bank account using the confirmed instructions. For domestic transactions in the U.S., large OTC trades often use Fedwire, which typically settles the same day if the transfer is initiated before the cutoff time (around 6:00 PM ET). ACH transfers are an option for smaller amounts but usually take 1–3 business days to clear. For international wires via the SWIFT network, expect a processing time of 1–2 business days, with T+1 settlement being the standard for cross-border trades.

Keep in mind that U.S. banks process transfers during specific hours, so after-hours or weekend transfers won’t start processing until the next business day. Once the wire is initiated, save the transaction reference number and any confirmation receipts. The seller should monitor their account for the incoming funds and confirm receipt before proceeding. Many institutional OTC desks provide real-time notifications when funds clear, which can make this step more efficient.

Step 4: Deliver or Release Crypto

Once the fiat funds have been received and cleared, the seller transfers the agreed cryptocurrency amount to the buyer’s designated wallet address. The transfer is recorded on the blockchain and can be verified using tools like Etherscan for Ethereum or Blockchain.com for Bitcoin.

To ensure security, wait for the required blockchain confirmations before finalizing the transfer. For Bitcoin, this typically means waiting for 3–6 confirmations, which takes about 30–60 minutes depending on network congestion. Ethereum and some other networks may confirm transactions more quickly. Institutional traders often use regulated custody solutions for added safety. Alternatively, if an escrow service is involved, the crypto is held until both parties confirm that their respective transfers are complete, reducing the risk of non-compliance. Once both fiat and crypto transfers are verified, move on to the final step.

Step 5: Post-Trade Reconciliation

After completing both the fiat and crypto transfers, conduct a final reconciliation to ensure everything matches the original trade agreement. Verify that the USD amount received and the cryptocurrency delivered align with the settlement instructions.

Maintain detailed transaction records, including bank statements, transaction IDs, and related communications. For U.S. traders, these records are essential for IRS reporting, as cryptocurrency is treated as property for capital gains purposes. Some OTC desks offer automated reporting tools to help compile this information. Partnering with services like BeyondOTC can also simplify the process by connecting you with established OTC desks and liquidity providers, ensuring compliance and proper record-keeping.

| Settlement Phase | Typical Timeframe for U.S. Traders | Key Verification |

|---|---|---|

| Fiat Transfer (Fedwire) | Same-day if before cutoff | Bank receipt, SWIFT MT103 |

| Fiat Transfer (ACH) | 1–3 business days | Bank portal confirmation |

| Crypto Delivery (Bitcoin) | 30–60 minutes (3–6 confirmations) | Block explorer verification |

| Crypto Delivery (Ethereum) | 5–15 minutes (12+ confirmations) | Etherscan transaction hash |

| Post-Trade Reconciliation | 1 business day | Final statements, tax records |

Risk Management and Best Practices in OTC Settlement

Common Settlement Risks

When it comes to OTC crypto settlement, risks generally fall into four main categories. First, there’s counterparty risk, which happens when one party either fails to deliver fiat or crypto as promised or delays payment beyond the agreed timeline. Then, there’s operational risk, which covers issues like sending funds to the wrong wallet address or bank account, choosing the wrong blockchain network (e.g., sending USDT on Tron instead of Ethereum), poor reconciliation processes, or breakdowns in internal approval workflows. Market risk comes into play when there’s a delay between the trade agreement and final settlement (e.g., T+1 or longer). During this time, price fluctuations can make one party unwilling – or even unable – to complete the transaction. Finally, legal and regulatory risks in the U.S. arise from incomplete KYC/AML checks, violations of sanctions, unclear tax obligations, or using unlicensed money transmitters or OTC providers. These risks can lead to fines, frozen funds, or other complications for both parties involved.

In real-world scenarios, these risks often translate into frozen bank wires, compliance holds at exchanges, rejected transactions, or disputes over what was agreed upon and when. For instance, if a USD wire transfer is initiated late on a Friday to an overseas bank, the delay in receiving funds over the weekend could spark disputes – especially if the market moves significantly during that time.

How to Reduce Settlement Risks

To minimize these risks, consider adopting several practical measures. Start by collecting and verifying key documents, such as government-issued IDs, proof of address, and, for entities, formation documents and information on beneficial ownership. Screen all counterparties against OFAC and similar watchlists, and document these checks. Implement AML procedures, including source-of-funds questionnaires, transaction monitoring with clear red flags, and defined escalation protocols.

For added security, use dual control when initiating and approving large transfers – both fiat and crypto. This means separating the roles of initiator and approver within banking platforms and custody solutions. Pre-approve wallet addresses with multi-person verification before their first use to guard against phishing or address substitution. Confirm the accuracy of routing details with small test transfers before moving larger amounts. Always validate settlement instructions prior to any transfer.

Choosing the right settlement model is also key. Escrow-based settlement involves a neutral third party holding crypto (and sometimes fiat) until both sides fulfill their obligations. This method significantly reduces principal risk and is especially useful for large trades, new counterparties, cross-border transactions, or illiquid assets where price volatility and fraud risks are higher. For T+0 settlements, where both fiat and crypto are exchanged on the same day, exposure to price movements is minimized. However, this approach requires well-coordinated operations during U.S. banking hours. Large transfers should also factor in blockchain conditions, using conservative confirmation requirements and time-stamped trade confirmations that clearly define price, settlement dates, and acceptable delays.

How Agencies Help Manage Risk

Specialized agencies play a crucial role in further reducing settlement risks by providing reliable connections and standardized processes. For example, agencies like BeyondOTC mitigate counterparty risk by connecting clients only with vetted OTC desks, institutional investors, and liquidity providers that meet strict KYC/AML and operational standards. This vetting ensures you’re working with reputable parties who have a proven track record.

These agencies also help streamline settlement workflows, ensuring clear documentation and collaboration with legal counsel to address U.S.-specific regulatory and contractual requirements. Acting as a neutral intermediary, they improve communication and manage expectations during the settlement process. BeyondOTC, for instance, operates across more than 50 countries, offering access to a network of verified investors and partners. Their services include deep liquidity pools, secure data sharing, and 24/7 trading support.

Before engaging with any agency, take the time to evaluate their regulatory standing, request references from previous institutional clients, and understand how they vet counterparties. It’s also essential to clarify whether the agency takes on principal risk or strictly acts as an introducer and advisor – this distinction determines who ultimately bears the settlement and credit risk.

Conclusion

Ensuring a secure OTC crypto settlement involves several critical steps: verifying KYC compliance and counterparty credentials, confirming trade terms in writing, cross-checking bank and wallet details through independent channels, executing transfers using the chosen settlement model, and reconciling each transaction. These measures help minimize risks like frozen wires, incorrect transfers, or disputes over agreed terms. Together, they create a solid foundation for a smooth and secure settlement process.

The settlement model you choose plays a key role in managing risk. Bilateral direct settlement works well for moderate deal sizes between trusted counterparties but involves higher risk. Desk-facilitated settlement, where a reputable OTC desk handles custody and ensures synchronized delivery-versus-payment, is ideal for most institutional trades, reducing operational and counterparty risks. For maximum security – especially with new relationships, cross-border deals, or large transactions – escrow-based settlement is the best option. Here, a neutral third party holds both parties’ assets until all conditions are satisfied.

Specialized agencies add another layer of security by connecting you with vetted OTC desks, institutional investors, and liquidity providers who have strong settlement controls in place. These agencies offer access to deep liquidity pools, round-the-clock trading support, and secure data sharing. They also serve as a single point of contact to manage timelines, documentation, and any potential disputes – essential when handling substantial sums.

To further enhance safety, follow these precautions: work exclusively with KYC-compliant desks or agencies, choose your settlement model based on the size of the transaction and the trust level with the counterparty, document all trade terms and instructions in writing, and prioritize delivery-versus-payment or escrow for high-value or cross-border trades. Keep detailed records of all bank statements, blockchain transaction hashes, and email confirmations for tax and compliance purposes. U.S. participants should also confirm that their banks can process crypto-related wires and maintain accurate USD valuations at the time of settlement to comply with IRS and FinCEN reporting requirements.

Never transfer funds without controlled settlement procedures and verified instructions. Always confirm identities via video or trusted corporate channels, verify wallet and bank details through at least two independent sources, and conduct a small test transaction before transferring the full amount when working with unfamiliar counterparties. For more complex or multi-party deals, consider partnering with an agency like BeyondOTC to coordinate desks, banks, legal teams, and counterparties. By adhering to these structured settlement practices, you can turn what might seem like a risky manual process into a streamlined, professional-grade workflow that safeguards both your capital and your confidence.

FAQs

What are the key differences between the main OTC settlement models?

The way OTC settlement models work can vary based on how trades are executed and risks are handled:

- Principal Model: Here, the OTC desk takes on the role of the counterparty, meaning it directly owns the assets during the trade. This setup allows for more control and flexibility but also carries a higher level of risk.

- Agency Model: In this model, the OTC desk acts more like a matchmaker, connecting buyers and sellers without ever taking ownership of the traded assets. This approach minimizes counterparty risk for everyone involved.

- Hybrid Model: As the name suggests, this model blends the two approaches. The OTC desk might act as a principal in some transactions and as an agent in others, depending on the specific deal and the needs of the client.

Each of these models comes with its own set of advantages and trade-offs, giving traders the ability to select the one that aligns best with their objectives and appetite for risk.

What steps should I take to meet KYC and AML requirements in OTC crypto trading?

To meet KYC (Know Your Customer) and AML (Anti-Money Laundering) requirements in OTC crypto trading, the first step is to verify your clients’ identities through comprehensive KYC checks. This involves gathering and confirming essential documents, such as government-issued IDs and proof of address.

Strengthen compliance by implementing solid AML practices. These include monitoring transactions for unusual patterns, flagging any suspicious behavior, and maintaining detailed records of trades and client interactions. It’s also crucial to stay informed about regulatory updates and adjust your policies accordingly to remain compliant.

Working with reputable partners like BeyondOTC can make this process easier. They help connect you with verified investors and partners, ensuring your OTC transactions are secure and meet compliance standards.

How can I reduce risks when settling OTC crypto trades?

When handling OTC crypto settlements, minimizing risks starts with confirming the identity and credibility of all parties involved. Conducting thorough background checks is crucial to ensure you’re dealing with legitimate and trustworthy individuals or entities. Incorporating a trusted escrow service can also act as a protective measure, securing funds throughout the transaction.

Beyond that, set up secure transaction protocols to protect the process and stay updated on market conditions to navigate potential price swings. Working with seasoned agencies that offer verified networks and professional advice can add another layer of security while simplifying the entire process.